Bruxelles, Tuesday 19th September, on this date have been released the data concerning machine tools production in Europe.

According to Cecimo, an association representing 1300 machine tools manufacturing companies in Europe, the 2017 growth rate has increased by 4%.

It also emerges from the data that the largest machine tool manufacturers countries are: Germany, Italy, and Switzerland. These Countries have increased their investments in machinery as they have been able to exploit the tax incentives adopted for helping the industry to move towards the digital revolution.

The Italian case

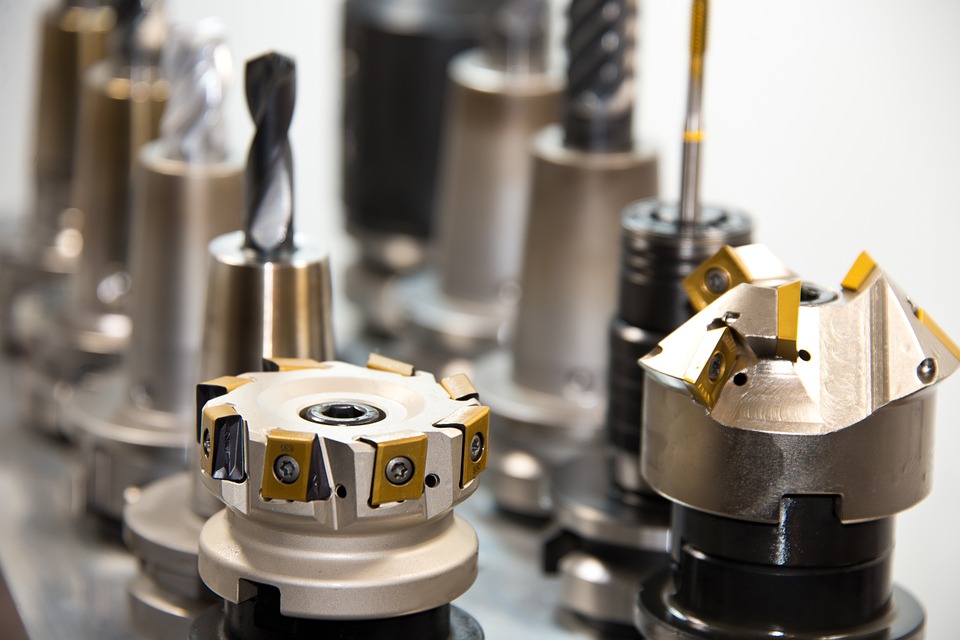

For example, in Italy, the government has decided to launch the National Industry Plan 4.0 2017-2020. This plan provides a range of tax incentives including over-amortization, a 250% increase in the acquisition cost of assets whose operation is controlled by cnc such as machine tools for chip removal, machine tools operating with electro-erosion , electrochemical processes, machines for plastic or sheetmetal production and other materials. (see Annex A of the Stability Law).

The French case

In France it has been created the Alliance Industrie du Futur, bringing together representatives of industry and digital technology with the aim of making France a leader Country in technological development of its companies. The task of this Alliance is to give a specific support to end-users to renew their companies and business models and to enter “full-scale” into the digitalized industrial world.

The German case

In Germany, instead, it has been created a network “Plattform Industrie 4.0” to support digitalization and moving to Industry 4.0. On this Platform there is a real close cooperation between politics, industry and science, trade unions and organizations. The goal is to support German companies in the modernization and digitalization of production systems, including machinery itself. This is why Germany is at the first place, the leader in machine tools production.

Europe

Going back to the issue of machine tools production, Europe, despite a slight drop in production recorded in 2016, from 68.9 billion to 64.2 billion (-7.9%), this year we state a rise in production volume of 2.4 billion euros with a positive forecast increase for the next two-years 2018 – 2019.

In addition, a quarter of machine tools produced by European companies are exported to other countries, not just Europeans. In fact, the main importers of European machine tools are China and the United States.

Chinese consumption, for example, has increased of 3.6%. American ones have also risen, despite the fact that 2018 includes protectionist barriers.

If you have any interest in knowing more about the production of China or US machine tools, write it in the comments!

Meanwhile, if you are interested in knowing Japanese production, we recommend you to read this article.

The Japanese economy in relation to the production of machine tools

For more information on Makinate or our used machine catalog, please visit our Makinate.com website and take a look at our machines by clicking the button below: