For several months now, the Greek contract manufacturer Famar has been facing a serious financial crisis. The future of the 12 sites currently operating in Europe has been uncertain for a long time. Last July, the Saint-Genis-Laval site (near Lyon) went into receivership, while the other European sites were put up for sale. But let’s see what the situation is like today.

The contenders to the “throne”

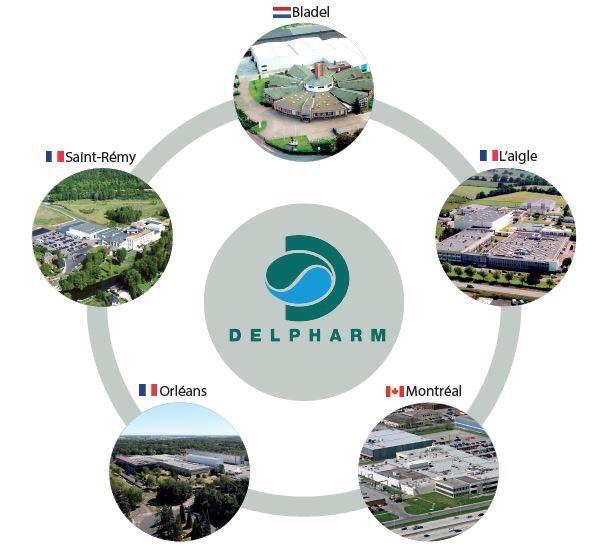

Since July, rumours have been circulating about the possible sale of some Famar sites. The sites in question are the three French sites of Orléans, Aigle and Saint-Rémy-sur-Avre, the Dutch site of Bladel and finally the Québec site of Pointe-Claire in Canada. If several contract manufacturers in the sector, such as Fareva or Recipharm for example, have expressed their interest in buying these plants, on balance, it was Delpharm that came out and finalised the acquisition.

With this acquisition, Delpharm brought home a turnover of 250 million euros and around 1300 employees – positions that should be maintained for the time being. Delpharm is therefore strengthening in Europe and North America. The group has now 4700 employees and 17 plants worldwide: 12 in France, 1 in Belgium, 1 in the Netherlands, 2 in Italy and 1 in Canada.

The situation in Saint-Genis-Laval

The Saint-Genis-Laval plant has been deemed unmarketable for the time being as it currently uses only 25% of its total production capacity, producing around 40 million drugs per year compared to the 110 million best times. The situation is therefore very delicate at the moment and the future for the employees of this site remains very uncertain.

The managing director of Famar would like to avoid a complete closure and the loss of all jobs, but nothing is safe yet. It is the only plant of the entire group to be at a loss, and that is why it has not been put up for sale as the other sites of the group.

A brief retrospective on the history of the Famar group ![]()

The Greek group Marinopoulos, present in the large distribution, founded Famar in 1949. Over the years the company has acquired several plants in Europe (Novartis in Orleans, Beecham in Italy, Aventis Pharma in L’Aigle, just to name a few) and in a short time has become a European leader in the development, production and distribution of pharmaceuticals for third parties.

With 12 production sites and more than 3000 employees, Famar was able to supply solid, liquid and semi-solid forms with important process machines and packaging lines.

Unfortunately, in recent years, the group has been in financial difficulties and the Marinopoulos family decided in 2017 to gradually sell its shares to the American investment fund KKR. The debt continued to rise to over 200 million euros and KKR gradually decided to dismantle the entire group and then put the production sites up for sale.

While the situation of 5 out of 12 sites is now clear and defined, we are waiting to know what will happen to the other plants of Famar. As for Delpharm, this CDMO is now positioned, thanks to this new acquisition, among the 5 world leaders in the pharmaceutical contract manufacturing sector.